Inattention cost of energy

Cap-and-trade in Energy Capacity Investment when the planner is inattentive

Cea-Echenique, Feijoo and Muñoz

UAndes, PUCV

July 2023

last update 2023-07-12

Outline

Motivation

- Decarbonization

- Contrast Tax versus Cap-and-trade

- Carbon pricing

- Environment responsability as an attention problem

Literature

- 2-stage stochastic capacity investment problems

(Ehrenmann and Smeers 2011; de Maere d ’ Aertrycke et al. 2017; Abada, de Maere d ’ Aertrycke, and Smeers 2017)

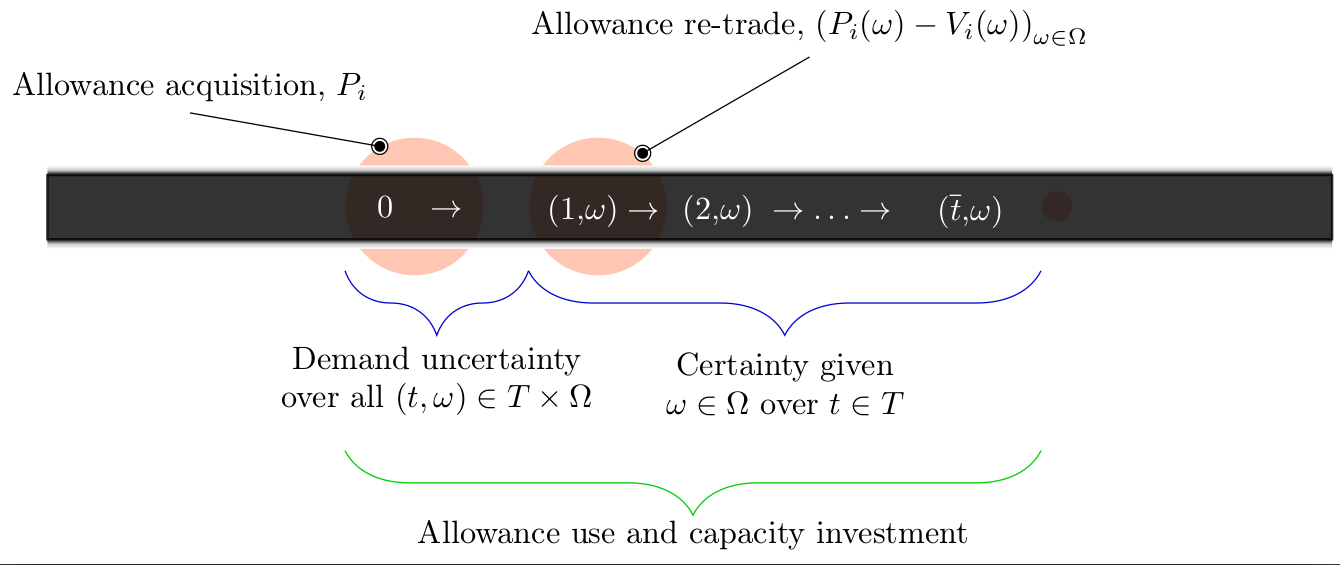

Model

- \bar t periods indexed by T

- \Omega finite set of states of nature

- P allowance long position

- V allowance short position

Demand

In the first stage period t=0,

- Exogenous demand D(0)\in\mathbb{R}_+.

In the second stage t\in T:=\{1,...\bar{t}\}, \omega\in\Omega

- Probability Pr(\omega)\in[0,1].

- Exogenous stochastic demand level D(t,\omega)\in\mathbb{R}_+^{T\times\Omega},

D=\left(D(0),(D(t,\omega))_{(t,\omega)\in T\times\Omega}\right)\in\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega}.

Producers: first stage

t=0, each producer i chooses

- Q_i(t)\in\mathbb{R}_+ generation quantity such that their revenue is maximized price \pi^d(0)\in\mathbb{R}_+

- \bar{Q}_i installed capacity for each producer at t=0

- A_i\in\mathbb{R}_+ carbon allowances at a price \pi^{a}\in\mathbb{R}_+

- x_i(t)\in\mathbb{R}_+ additional capacity with a capital expenditure of I_i\in\mathbb{R}_+ (The additional capacity becomes available after a predefined building time (in years))

Producers: second stage

In the second stage, for each pair (t,\omega), producer i maximizes its profit by choosing

- Q_i(t,\omega)\in\mathbb{R}_+ the generation level at a price \pi^d(t,\omega)\in\mathbb{R}_+

- TC_i(t) \in\mathbb{R}_+ technology change that adjusts the marginal cost of different technologies.

- x_i(t,\omega)\in\mathbb{R}_+ additional capacity with an investment cost of TCR_i(t)\cdot I_i, where TCR_i(t)\in\mathbb{R}_+ is the change in the investment cost or capital expenditure over time

- P_i(\omega)\in\mathbb{R}_+ long position in permits from other producers if they need to surpass the initial allowances allocation A_i

- V_i(\omega)\in\mathbb{R}_+ short position in allowances

- \pi^v(\omega)\in\mathbb{R}_+ permits retrade price

Producers

The choice set of the producer i over a time horizon of \bar{t} years is given by:

- an amount of capacity expansion x_i:=\left(x_i(0),(x_i(t,\omega))_{(t,\omega)\in T\times\Omega}\right)\in\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega},

- a production plan Q_i:=\left(Q_{i}(0),(Q_{i}(t,\omega)_{(t,\omega)\in T\times\Omega})\right)\in\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega},

- allowances A_i\in\mathbb{R}_+ bought in the first period t=0,

- allowances P_i(\omega)\in\mathbb{R}_+^{\Omega} bought in t=1 for time interval t\in[1,\bar{t}]

- allowances V_i(\omega)\in\mathbb{R}_+^{\Omega} sold in t=1 for time interval t\in[1,\bar{t}].

Given electricity prices \pi^d:=\left(\pi^d(0),\left(\pi^d(t,\omega)\right)_{(t,\omega)\in T\times\Omega}\right)\in\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega} and parameters (a_i,b_i)_{i\in\{1,...N\}}\in(\mathbb{R}^2_+)^N, f_i(p,q)=\Big(a_i\cdot q+\frac{b_i}{2}\cdot q^{2}\Big)-p\cdot q revenue function.

Producers: Objective

Defining T_0:=\{0\}\cup T, the optimization problem of producer i is given by choosing

- (x_i,Q_i, A_i,P_i,V_i)\in\mathbb{X}:=\left(\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega}\right) \times\left(\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega}\right) \times \mathbb{R}_+\times\mathbb{R}_+^{\Omega}\times\mathbb{R}_+^{\Omega}

- given prices (\pi^d, \pi^a , \pi^v)\in\Pi:=\left(\mathbb{R}_+\times\mathbb{R}_+^{T\times\Omega}\right)\times\mathbb{R}_+\times\mathbb{R}^{\Omega}_+,

- parameters \left((a_i,b_i),I_i, TC_i(t,\omega), TCR_i(t,\omega), CF_i,\bar{Q}_i, RP_i , \varepsilon_i\right)\in \Xi:=\mathbb{R}_+^2\times\mathbb{R}_+^7, \tau\in \mathbb{R}_+

- and probability (Pr(\omega))_{\omega\in\Omega}\in\Delta:=\left\{\left(Pr(\omega)\right)_{\omega\in\Omega}\in[0,1]^K:\sum_{\omega\in\Omega}Pr(\omega)=1\right\} as a solution of

\min_{(x_i,Q_i,A_i,P_i,V_i)\in \mathbb{X}} f_i \big( \pi^d(0),Q_i(0)\big)+ A_i \pi^{a} + I_i x_i(0)

+ \sum_{\omega} Pr(\omega) \Bigg[ \sum_{t>0} \frac{1}{(1+R)^t} \Big[ TC_i(t)\cdot f_i \big( \pi^d(t,\omega),Q_i(t,\omega) \big)

+ TCR_i(t) \cdot I_i\cdot x_i(t,\omega) \Big] + \pi^v(\omega)\cdot \big(P_i(\omega)-V_i(\omega)\big) \Bigg]

\Big(CF_i \cdot\tau\Big) \Bigg[\bar{Q}_i + x_i(0)+\sum_{t^{\prime}<t-lag_i} x_i(t^\prime,\omega) \Bigg] - Q_i(t,\omega) \geq 0,\forall \, i,\omega, t > 0 \, (\alpha_{i,\omega,t})

(CF_i\cdot\tau)\bar{Q}_i-Q_i(0)\geq 0 \qquad \forall \quad i\quad (\kappa_i) RP_i - \bar{Q}_i - x_i(0) - \sum_{t > 0} x_i(t,\omega) \geq 0 \qquad \forall \quad i,\omega \quad (\psi_{i,\omega})

A_{i}-V_i(\omega)\geq 0 \qquad \forall \quad i,\omega \quad (\beta_{i,\omega})

A_{i} + (P_i(\omega) - V_i(\omega))-\sum_{t>0}Q_i(t, \omega)\cdot \varepsilon_{i}-Q_i(0)\varepsilon_{i} \geq 0 \qquad \forall \quad i, \omega \quad (\gamma_{i,\omega})

Auctioneer: Amigo et alii (2021)

- \theta\in \mathbb{R}_+ available allowances at a price \pi^a in stage t=0.

- The price is set such that it clears the CO_2 permit market among generators and the auctioneer.

- CAP\in\mathbb{R}_+ carbon budget (maximum level of CO_2 emissions allowed in the second stage t\in T) and is drawn from a normal distribution, i.e., CAP \thicksim N(\mu, \sigma^2).

Pr(\theta \geq CAP) \leq \epsilon

- Objective \min_{\theta} -\theta \pi^{a} + \mathcal{F}(\theta)\quad\text{s.t }\quad\phi^{-1}(\epsilon) \sigma + \mu - \theta \geq 0

Equilibrium

The data that parameterize the capacity investment model is given by the tuple (\tau,(Pr(\omega))_{\omega\in\Omega},\left(CAP,\mu,\sigma,\epsilon\right),((a_i,b_i),I_i, TC_i(t,\omega), TCR_i(t,\omega), CF_i,

\bar{Q}_i, RP_i , \varepsilon_i)_{i\in N})\in \mathbb{R}_+\times \Delta\times\mathbb{R}_+^4\times\Xi^N,

DEFINITION. An equilibrium in the capacity investment model is a vector of prices and production decisions \left((\pi^{d*},\pi^{a*},\pi^{v*}),(x_i^*,Q_i^*,A_i^*,P_i^*,V_i^*)_{i\in\{1,...,N\}},\theta^*\right)\in\Pi\times\mathbb{X}^N \times \mathbb{R}_+ such that:

(x_i^*,Q_i^*,A_i^*,P_i^*,V_i^*) minimizes the cost for each producer i\in\{1,...,N\} - \theta^* minimizes the auctioneer cost - Market clearing conditions are satisfied:

- available allowances t=0 \sum_{i} A_{i}^* = \theta \ \ {\color{blue}{(\pi^{a*})}}

- equilibrium in trading market t>0 \sum_{i} P_{i,\omega}^* = \sum_{i} V_{i,\omega}^* \forall \ \omega \ \ {\color{blue}{\left(\pi^{v*}(\omega)\right)}}

- fulfillment of the demand: first stage \sum_{i} Q_i(0)^* = D(0), \ \ {\color{blue}{(\pi^{d*}(0))}}

- fulfillment of the demand: second stage \begin{array}{ll}\sum_{i} Q_i(t,\omega)^* = D(t,\omega), &\forall \ \omega, t\\ & {\color{blue}{(\pi^{d*}(t,\omega))}}\end{array}

Rational Inattention

Following Dewan and Neligh (2020) we consider a quadratic cost function

C(P)=\begin{cases}0,&Perf\leq d\\c(Perf-d)^2,&Perf>d\end{cases},

where Perf\in[0,1] is a performance metric, c an associated marginal cost and d the performance level wiht public information.

We drop the chance constraint approach, by using

- \min_{(\theta,Perf)\in[0,(1+\epsilon)CAP]\times[0,1]}-\theta\pi^aPerf+c(Perf-d)^2 profit oriented

- \min_{\theta\in[0,CAP]}-\theta\pi^a+c\left(1-\frac{|\theta-CAP|}{CAP}-d\right)^2 welfare oriented

Results: Profit oriented

- Calibration wrt Amigo, Cea-Echenique, and Feijoo (2021)

- CAP: 100 MtCO_2

- \pi^a=315.83

- \epsilon=0.202 Andres et alii (2014) \Rightarrow c=920M

CAP=100

| Perf | \theta | \frac{\theta}{CAP} | \pi^a |

|---|---|---|---|

| 0.798 | 120,200,000 | 1.20 | 270.13 |

| 0.8 | 120,200,000 | 1.20 | 270.13 |

| 0.85 | 113,654,321 | 1.14 | 25.75 |

| 0.9 | 113,568,965 | 1.14 | 93.65 |

| 0.95 | 118,470,479 | 1.18 | 188.86 |

| 0.99 | 114,916,396 | 1.15 | 298.11 |

| 1 | 118,332,486 | 1.18 | 317.24 |

Results: multiple CAPs, Perf=0.8

| CAP | \theta | \frac{\theta}{CAP} | \pi^a |

|---|---|---|---|

| 100,000,000 | 120,200,000 | 1.20 | 270.13 |

| 200,000,000 | 240,400,000 | 1.20 | 60.57 |

| 300,000,000 | 360,600,000 | 1.20 | 119.47 |

| 400,000,000 | 454,798,037 | 1.14 | 95.83 |

| 500,000,000 | 601,000,000 | 1.20 | 79.31 |

| 600,000,000 | 605,279,899 | 1.01 | 66.57 |

| 700,000,000 | 605,279,899 | 0.86 | 56.37 |

| 800,000,000 | 961,600,000 | 1.20 | 152.50 |

| 900,000,000 | 605,279,899 | 0.67 | 42.26 |

| 1,000,000,000 | 605,279,899 | 0.61 | 35.98 |

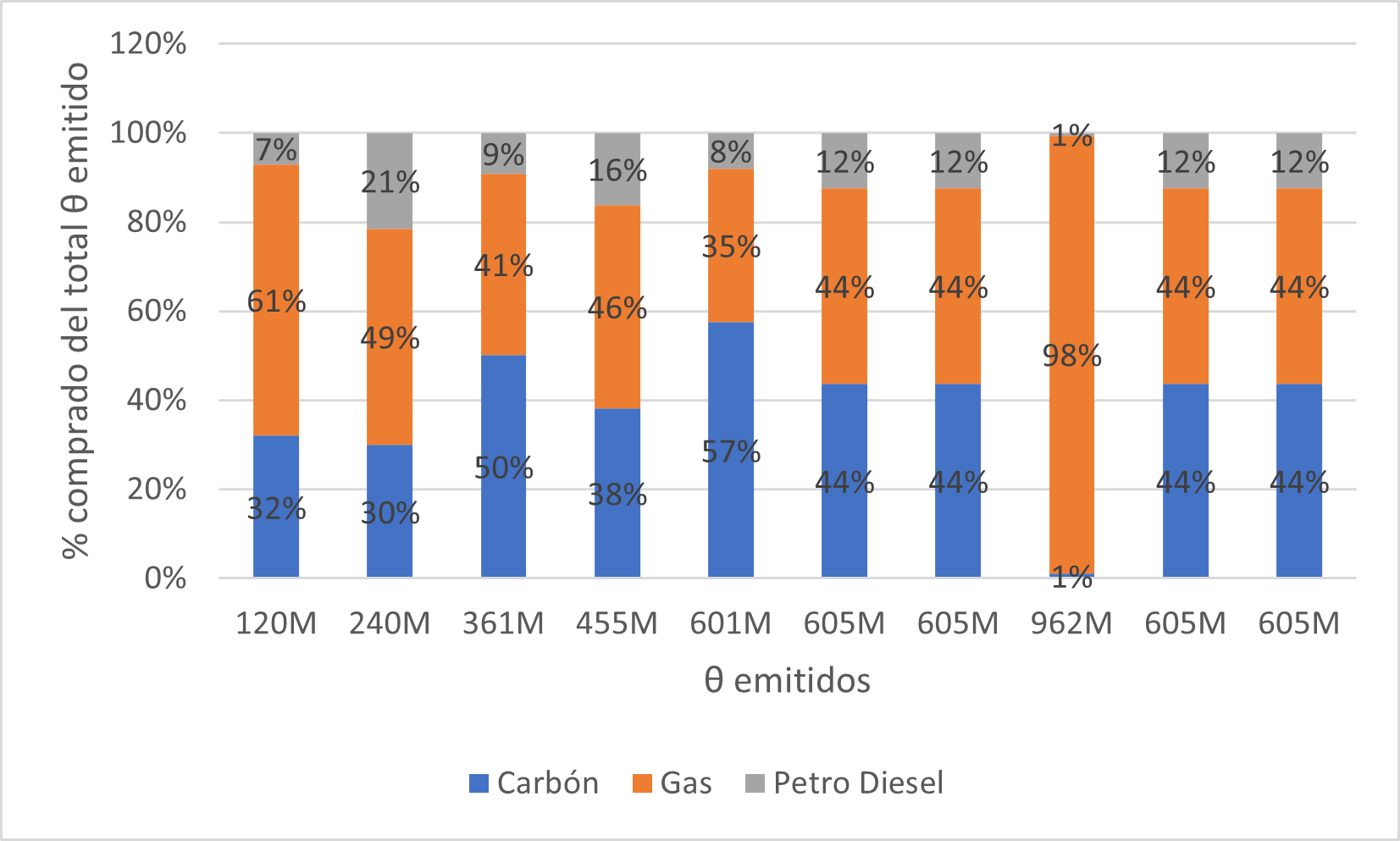

Results: Profit oriented, allowances distributions

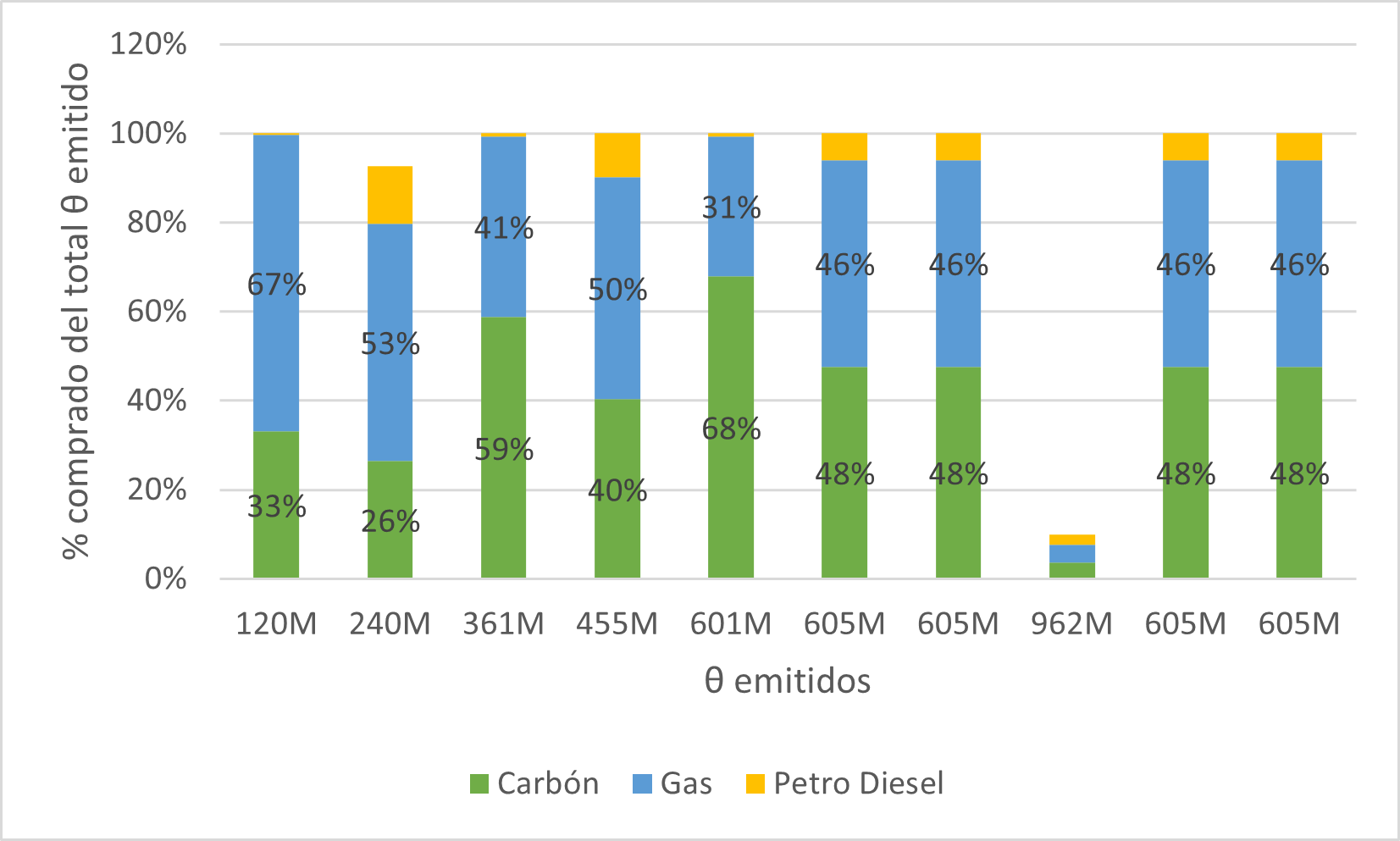

Results: Welfare oriented

- Calibration wrt Amigo, Cea-Echenique, and Feijoo (2021)

- CAP: 100 MtCO_2

- \pi^a=315.83

\Rightarrow c=9920M

| CAP (M) | \theta | Perf | \frac{\theta}{CAP} | \pi^a |

|---|---|---|---|---|

| 100 | 144,944,410 | 0.798 | 1.449 | 232.82 |

| 200 | 289,888,820 | 0.798 | 1.449 | 141.56 |

| 300 | 434,833,230 | 0.798 | 1.449 | 103.33 |

| 400 | 579,777,640 | 0.798 | 1.449 | |

| 500 | 653,754,577 | 0.905 | 1.308 | 37.27 |

| 600 | 619,939,821 | 0.999 | 1.033 | 40.43 |

| 700 | 661,258,561 | 0.997 | 0.945 | 36.42 |

| 800 | 610,913,181 | 0.944 | 0.764 | 31.28 |

| 900 | 609,127,279 | 0.896 | 0.677 | 31.21 |

| 1,000 | 698,676,376 | 0.909 | 0.699 | 30.00 |

Final Remarks

- Respect of aggregate demand law

- Unclear relation of inattention

- Multiple solutions and comparative statics